Wondering if selling on Facebook is legal? This is a question that also troubles many novice sellers. Let's dive into the world of regulations and guidelines to get to know them better and dispel your doubts!

How to sell legally on Facebook?

When you consider starting to sell online, Facebook is one of the first places that comes to mind. But before you start selling your products, you need to find out if it's legal to sell on Facebook. The assumption that selling on Facebook is just about uploading a picture of a product and adding a price is wrong. To effectively use this platform as a sales tool, it's worth knowing some key information that will help you run your business effectively and legally.

Facebook regulations and selling on Facebook

Facebook has specific regulations regarding sales activities. Not all products and services are allowed to be sold. Weapons, drugs, alcohol or adult services are explicitly prohibited. Ignoring these guidelines can lead to account blocking or other sanctions.

Marketplace - a dedicated space for sellers

Facebook has created a special platform for sellers - Marketplace.This is a place where users can directly offer their products to the local community. With clearly defined categories, it is easier to reach the right target group.

Sales groups - building a community

Sales groups are a great way to build a community around a specific product or service.You can share offers there, encourage discussion and gather feedback. However, it's worth remembering that each group has its own rules that must be followed.

Facebook ads - the paid way to greater visibility

If you want to increase the reach of your offer, it's worth considering paid Facebook ads. They allow you to reach a precisely defined target audience.

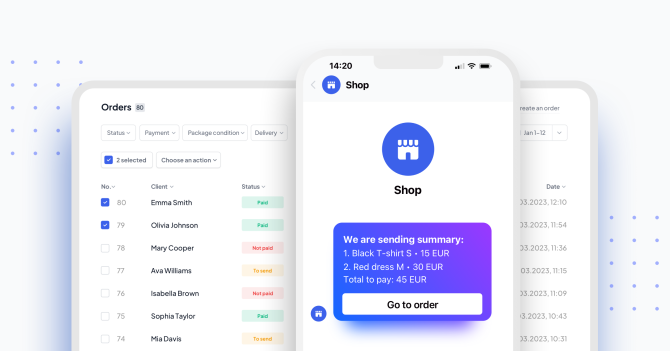

Facebook likes have become one of the most dynamic tools in online marketing. They allow real-time interaction with potential customers. Presenting products and answering questions, they build trust in the brand. An effective presentation, during a live broadcast, can not only increase sales, but also strengthen the bond with customers and create a sense of community around the products or services offered. The Selmo specialist can help you manage your sales and customer communication processes as effectively as possible.

Selling on Facebook and Instagram without a business

Selling on Facebook and Instagram without a business has become popular among many people who want to earn extra money or simply get rid of unnecessary items. However, before starting such sales, there are a few things to consider. First of all, selling on a large scale without proper reporting can expose the seller to legal and tax consequences. Secondly, it's worth keeping safety in mind and ensuring that transactions are conducted in a fair and transparent manner.

What can be sold online without a business?

Many people are looking for a way to earn extra income and are wondering about the question of what can be sold online without a business. Here are general rules and examples of what you can sell:

-Occasional sales - you can sell used items that you don't need at home, such as clothing, electronics, furniture or books. This is considered an occasional sale and does not require a business;

-Handicrafts - if you create something by hand, such as jewelry, paintings, handmade toys or decorations, you can sell them. If it starts to bring in regular income, consider starting a business;

digital products - you can create and sell digital products: e-books, photographs or online courses. If sales become professional, you may need to establish a business;

collectible products - old coins, stamps, collector cards or antiques can be sold without a business, as long as it is not on a commercial scale.

Up to what amount can you sell tax-free?

As of July 1, 2023, the monthly limit of unregistered activity is 75% of the amount of the minimum monthly salary, or PLN 2,700 per month.

Legal selling on social media

Selling on Facebook is undoubtedly an attractive tool for many sellers, but it requires knowledge of certain rules. It is important to always be guided by the rules and regulations of a given platform and adjust your actions accordingly. It is worth keeping up to date with current tax and legal regulations. In this way, you can ensure not only efficiency in your operations but also peace of mind. It is given by the knowledge that ventures are fully legal. Above all, remember that honesty and transparency with customers builds a lasting relationship and trust, which are the keys to success in any online business.